ARGUMENT ANALYSIS

on Feb 28, 2023

at 6:51 pm

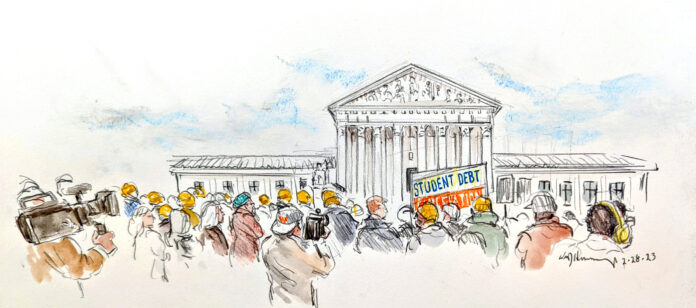

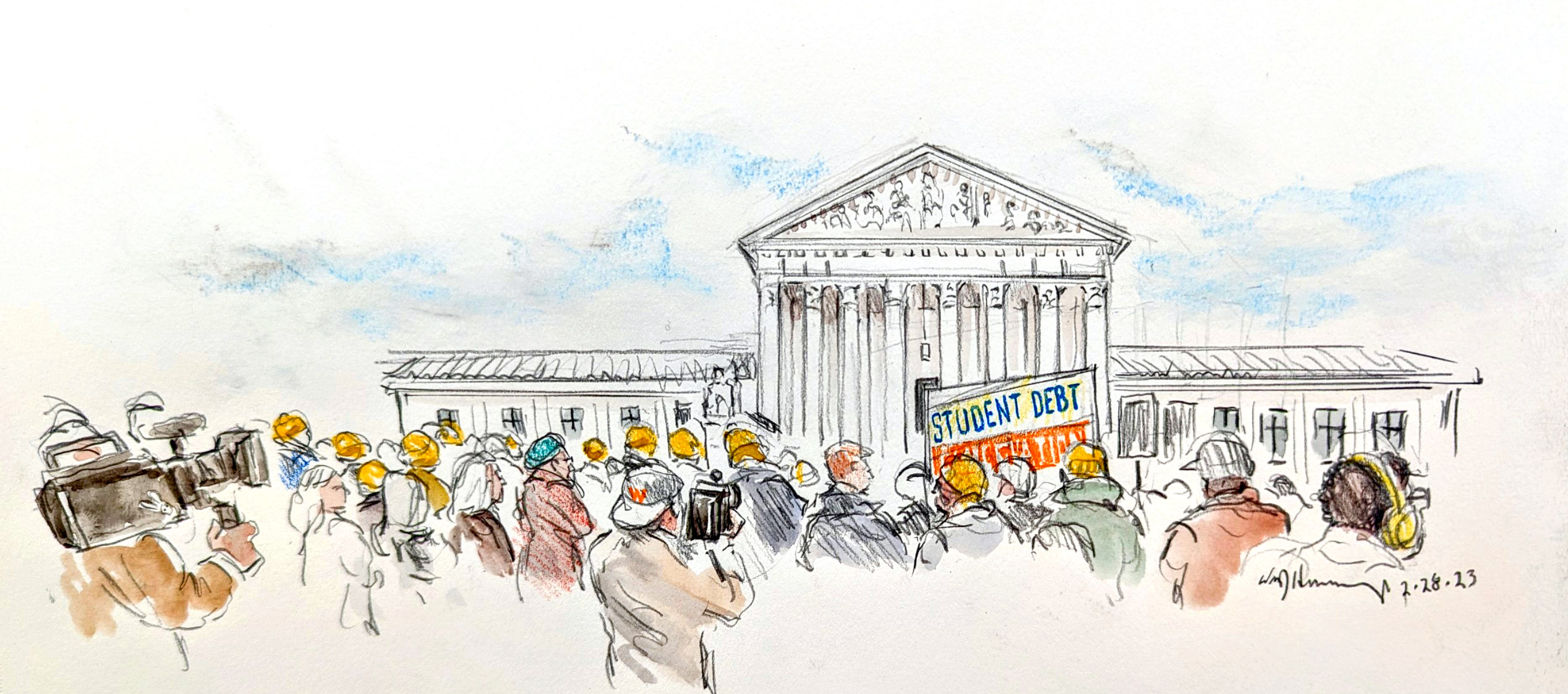

Supporters of President Biden’s student-debt plan gather outside the Supreme Court on Tuesday. (William Hennessy)

The Supreme Court on Tuesday appeared skeptical of the Biden administration’s student-loan debt-relief program. During nearly three and a half hours of oral arguments, a majority of the justices appeared unconvinced that Congress intended to give the secretary of education the power to adopt the program, which has an estimated price tag of $400 billion.

A ruling in favor of the challengers would obviously be a major blow for President Joe Biden, who enacted the debt-relief program to fulfill a campaign pledge. But the court’s decision could also have a much broader legal impact, affecting when and how states can go to court to challenge federal policies and how courts should interpret other laws giving powers to federal agencies.

Biden announced the debt-relief program, which would forgive up to $20,000 in loans for qualifying borrowers, last August. At that point, student-loan repayments had already been on hold for nearly two years: In March 2020, then-Secretary of Education Betsy DeVos suspended both repayments and the accrual of interest on federal student loans because of the COVID-19 pandemic. Both DeVos and the Biden plan relied on the HEROES Act, a law passed after the Sept. 11 attacks that gives the secretary of education the power to respond to a “national emergency†by making changes to the student-loan programs so that borrowers are left not worse off because of the emergency.

Two separate challenges were before the court on Tuesday, but the justices spent most of their time and energy on the first case, which is known as Biden v. Nebraska and was filed by six states with Republican attorneys general.

The states’ challenge

The justices will reach the merits of the states’ claims only if they first agree with the U.S. Court of Appeals for the 8th Circuit that the states have a legal right to sue, known as standing. The states’ primary argument is that Missouri has standing because it created and controls the Missouri Higher Education Loan Authority, one of the largest holders and servicers of student loans in the United States. The loan-forgiveness program, Nebraska Solicitor General James Campbell told the justices, “threatens to cut MOHELA’s†funding by nearly 40%. Because all funds beyond operating revenues go to support student financial aid in Missouri, Campbell emphasized, a reduction in MOHELA’s revenues will mean less money for financial aid in Missouri.

Representing the Biden administration, U.S. Solicitor General Elizabeth Prelogar told the justices that even if MOHELA might be harmed by the loan-forgiveness program, that would not be enough for Missouri to bring a lawsuit.

Elizabeth Prelogar argues for the Biden administration. (William Hennessy)

The court’s liberal justices appeared sympathetic. Justice Elena Kagan agreed that MOHELA might have a right to sue – but, she noted, it hasn’t done so. Normally, Kagan noted, you can’t sue on someone else’s behalf, which would preclude a lawsuit by Missouri. And indeed, she added, Missouri has derived substantial benefits from creating MOHELA as an independent entity.

Justice Sonia Sotomayor echoed Kagan’s concerns. It’s “hard to imagine how … Missouri can claim an injury†when MOHELA is a separate entity, independent from the state.

And Justice Ketanji Brown Jackson raised a broader question. Noting that in his opening statement Campbell had accused the Biden administration of trying to bypass Congress “on one of today’s most debated policy questions,†she countered that the justices “have to be concerned about jumping into the political fray†unless they’re doing so in a case in which someone has standing.

But Justice Samuel Alito appeared unconvinced. For purposes of standing, he asked Prelogar, has the Supreme Court ever decided whether an entity like MOHELA is part of the state?

If the court’s liberal justices were dubious about the states’ right to sue, the court’s conservative justices appeared just as skeptical about whether the Biden administration could rely on the HEROES Act to adopt the loan-forgiveness program.

Some of that skepticism focused on the text of the HEROES Act itself – and, in particular, its grant of authority to the secretary of education to respond to a national emergency by “waiv[ing] or modify[ing] any statutory or regulatory provision†governing the student-loan programs. Justice Clarence Thomas asked Prelogar whether the loan-forgiveness program was a waiver or, alternatively, a modification of existing student-loan programs. When Prelogar responded that the program both waived and modified existing programs, Thomas noted that Congress had specifically referred in other provisions to the cancellation of student-loan debt, but it had not done so here. Because Congress specifically uses the term “cancellation†elsewhere, he asks, how does a waiver or modification become a “cancellationâ€? Â

A few minutes later, Thomas returned to the question of the proper label for the Biden administration’s actions. “In effect,†Thomas posited, “this is a grant of $400 billion, and it runs headlong into†the Constitution’s requirement that only Congress can appropriate money.

Chief Justice John Roberts was skeptical that the loan-forgiveness program was a mere “modification†of existing student-loan loans. “We’re talking about half a trillion dollars and 43 million Americans,†Roberts observed. “How does that fit under the normal understanding of ‘modifying’?â€

Justice Brett Kavanaugh was slightly more receptive to the government’s argument. You have a good argument that “modify†does not allow the Department of Education to cancel student loans, he told Campbell. But “waive†is “an extremely broad word,†he said.

Justice Neil Gorsuch focused on another requirement of the HEROES Act, which gives the secretary of education the power to waive or modify provisions governing the student-loan programs so that borrowers are “not placed in a worse position financially†because of the national emergency.

Campbell told Gorsuch that the loan-forgiveness program, rather than ensuring that borrowers are not placed in a worse position financially, “goes well beyond putting them back in the status quoâ€: For 20 million borrowers, the program will eliminate all of their debt, while the average debt for the other 20 million borrowers who will benefit from the loan-forgiveness program will be reduced from $29,000 to $13,000.

James Campbell argues for the states challenging the program. (William Hennessy)

Kagan interpreted the HEROES Act very differently. When Campbell reiterated that the act gives the secretary of education the power to waive or modify student-loan laws and regulations, not to cancel debt, Kagan countered that the law is “quite clear.†Congress gave the secretary the power to waive or modify existing provisions and to add new ones in their place. “This is a bill about what happens when you have an emergency,†Kagan continued. “Congress doesn’t get much clearer than that.â€

Some of the conservative justices also suggested that the loan-forgiveness program might fail under the “major questions doctrine,†a principle of statutory interpretation that rests on the idea that, if Congress wants to give an administrative agency the power to make “decisions of vast economic and political significance,†it must say so clearly.

Prelogar resisted any suggestion that the major-questions doctrine applied to the loan-forgiveness program. Unlike earlier cases in which the court has applied the doctrine, she suggested, the Department of Education is not “claiming extravagant regulatory authority that it doesn’t actually have.†What’s more, she added, the loan-forgiveness program does not involve the department’s regulatory authority at all; instead, Congress in the HEROES Act gave the department broad power to provide benefits to borrowers.

Alito was skeptical of Prelogar’s efforts to draw a line between regulatory programs and programs involving benefits. “Drawing a distinction between benefits programs and other programs seems to presume that when it comes to the administration of benefits programs, a trillion dollars here, a trillion dollars there, it doesn’t really make that much difference to Congress.†Â

Roberts was firmly in the camp that the major-questions doctrine applies to the loan-forgiveness program. He observed that, in the Biden administration’s view, the Department of Education was not required to give the public an opportunity to comment on the program before it was adopted, that there “was no role for Congress to play in this,†and – because of the administration’s argument that the challengers lack standing – “there’s no role for us to play in this†dispute either. But “we take very seriously,†Roberts told Prelogar, the idea that power should be divided among the three branches of government to prevent its abuse.

The administration’s handling of the program, Roberts said, reminded him of the Trump administration’s efforts to end an Obama-era program that allowed undocumented young adults who came to the United States as children to apply for protection from deportation. (In that case, Roberts joined the court’s liberal bloc in holding that the Trump administration acted improperly in terminating the program.) “And I just wondered,†he asked Prelogar, whether “you would recognize that this is a case that presents extraordinarily serious, important issues about the role of Congress and about the role that we should exercise in scrutinizing that – significant enough that the major questions doctrine ought to be considered implicated?â€

Kavanaugh also expressed concerns that the secretary of education had overstepped the authority provided by the HEROES Act. Congress, he said, could have referred to loan forgiveness or loan cancellation in the HEROES Act, but it didn’t. Kavanaugh suggested that the court was confronting a familiar, and in his view “problematic,†scenario, involving an old statute with general language. After Congress considered legislation but ultimately declined to pass a new program to address a specific problem, the executive branch then went ahead and adopted the program on its own.

Prelogar again pushed back, telling Kavanaugh that the loan-forgiveness program is not “taking an old statute and dusting it off.†Even if Congress did not take action to cancel student-loan debt itself, she observed, it passed the American Rescue Plan, which anticipated that student-loan debt would be canceled and therefore provided that canceled debt would not be subject to federal taxes.

Sotomayor pushed back as well, emphasizing the real-world effects of the loan-forgiveness program. There are, she stressed, “50 million students who will benefit from†the program. These borrowers, Sotomayor said, do not have assets or friends or family to help them when they face financial problems as a result of the pandemic, and things will only get worse if they default on their loan repayments as a result.

The states, she told Campbell, want to give judges “the right to decide how much aid to give†these borrowers, instead of leaving the determination to the secretary of education, who has the experience and expertise to make that kind of decision.

The individuals’ challenge

The second case, Department of Education v. Brown, was filed by two student-loan borrowers, Myra Brown and Alexander Taylor. Brown was not eligible for any relief under the Biden program because her loans are held by commercial lenders; Taylor was eligible for $10,000 in relief but not the full $20,000 available to some borrowers. They argue that if the Biden administration had followed the procedural requirements that normally apply to federal agencies, they would have had a chance to advocate for a different program.

Prelogar urged the justices to hold that neither Brown nor Taylor has standing to challenge program. If they win, she said, the program would be invalidated and no one – including them – would benefit from the program.

But lawyer J. Michael Connolly, representing Brown and Taylor, countered that his clients have standing to sue as long as they can show some possibility that their debts would be forgiven – which, he said, is likely considering that the loan-forgiveness program is a “top priority†for the Biden administration.

J. Michael Connolly argues for the individual challengers. (William Hennessy)

Once again, the court’s liberal justices raised questions about the challengers’ standing to sue. Jackson noted that Connolly’s theory “relies on the assumption that if the court strikes down this program,†the Biden administration will enact another similar program. But what if, she asked, the secretary of education believes he only has the power to adopt a program under the HEROES Act, and the COVID-19 emergency has ended?

Sotomayor was even more dubious, calling Connolly’s argument “totally illogical.†The HEROES Act, she said, does not require the secretary of education to provide the public with an opportunity to submit comments on a proposed loan-forgiveness program. “If you don’t get an opportunity to be heard,†she said, “no one else does†either.

Prelogar emphasized that the court could only find that Brown and Taylor have standing based on what she characterized as a “bank shot†– the idea that, if the current version of the program is struck down, the Department of Education will decide to adopt a new loan-forgiveness program, under a different statute, from which Brown and Taylor will benefit. But it wasn’t clear that a majority of justices agreed with her.

Some of the court’s conservative justices had concerns about what they saw as the fairness (or lack thereof) of the loan-forgiveness program. Roberts described a hypothetical situation in which one young adult takes out loans to go to college, while another young adult starts a lawn-care business with a loan from a bank. Statistically, Roberts observed, the college graduate is more likely to be better off financially, so why should the government forgive his loan but not the loan for the business owner? The question of how to spend the government’s money, Roberts continued, is a question for Congress, rather than the courts.

Prelogar countered that Congress in the HEROES Act decided to focus on student-loan repayment, and Kagan echoed that argument a few minutes later. The secretary of education, Kagan said, did not have any authority to forgive business loans.

Sotomayor chimed in, noting that everyone suffered during the COVID-19 pandemic in some ways. There is an “inherent unfairness in society,†she suggested, because the U.S. government does not have unlimited resources.

In her rebuttal, Prelogar described the loan-forgiveness program as a “critical lifeline†to ensure that the borrowers who would qualify for the program “are not subject to the severe negative consequences of delinquency and default on student loan debt.†She urged the justices to reject the challengers’ claims, but the majority of the justices did not necessarily seem persuaded on Tuesday.

A decision in both cases is expected by late June or early July.

This article was originally published at Howe on the Court.